- Messages

- 1,080

- Reaction score

- 3,160

- Points

- 273

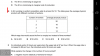

govt borrows money, money supply falls. therefore interest goes upView attachment 44522

how Bi read the examiners report , it says net exports will reduce because currency will appreciate , but how do we know if we hav to see the long term or short term effects ?

interest goes up, there will be inflow of money into country (hot money) so demand for currency goes up, which appreciates the currency

appreciation means, exports are expensive, and imports are cheaper, exports fall