-

We need your support!

We are currently struggling to cover the operational costs of Xtremepapers, as a result we might have to shut this website down. Please donate if we have helped you and help make a difference in other students' lives!

Click here to Donate Now (View Announcement)

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economics, Accounting & Business: Post your doubts here!

- Thread starter XPFMember

- Start date

- Messages

- 60

- Reaction score

- 64

- Points

- 28

@

farah36

This is a DISCUSS question. This means you have to give two sides of the argument. You will have to handle this question from two angles. firstly you will have to discuss if the given statement can be supported by an economic analysis (model/ theory/ policy) or if there is no economic analysis that can give a clear support or opposition to the statement with certainity. Secondly, if it can be supported by an economic analysis, then up to what extent can you support it (also discuss the relevant economic analysis) and what are the limitations of using any economic analysis to support the statement.

By the way from which year is this question from

An economist stated you cannot encourage economic growth and cut spending and increase taxes at the same time.

q) Discuss whether economic analysis can be used to support the statement of the economist?[13]

Please explain the answer

farah36

This is a DISCUSS question. This means you have to give two sides of the argument. You will have to handle this question from two angles. firstly you will have to discuss if the given statement can be supported by an economic analysis (model/ theory/ policy) or if there is no economic analysis that can give a clear support or opposition to the statement with certainity. Secondly, if it can be supported by an economic analysis, then up to what extent can you support it (also discuss the relevant economic analysis) and what are the limitations of using any economic analysis to support the statement.

By the way from which year is this question from

- Messages

- 64

- Reaction score

- 26

- Points

- 18

hi

can someone help me calulate the net debt of costello..

Q2 (c)

ACCOUNTS

October november 2010, Paper 4 Variant 2

For this u hav to find increase or decrease in debt

Opening Balance (580-500) 80

(-)Cash increase/(decrease) during year (667)

(+)Debenture repurchase 140 (this will decrease your debt)

= Closing debt which is (360 + 87) (447)

Decrease in debt is added and increase in debt is subtracted

- Messages

- 122

- Reaction score

- 242

- Points

- 43

Ques 9 of this pls help! http://www.sheir.org/a-level-accounting-32-nov2013.pdf

For this u hav to find increase or decrease in debt

Opening Balance (580-500) 80

(-)Cash increase/(decrease) during year (667)

(+)Debenture repurchase 140 (this will decrease your debt)

= Closing debt which is (360 + 87) (447)

Decrease in debt is added and increase in debt is subtracted

- Messages

- 122

- Reaction score

- 242

- Points

- 43

Heyyy, regarding your CRR ques, I think you're right. My lecturer actually told me some of the CRR answers in the scheme is wrong.Yes.... This might help you!

- Messages

- 64

- Reaction score

- 26

- Points

- 18

Ques 9 of this pls help! http://www.sheir.org/a-level-accounting-32-nov2013.pdf

IAS 36 states that Asset should not be Written in statement of Financial Position (Balance Sheet) at more than their recoverable amount.

Recoverable Amount = Higher of (Fair value less cost of disposal) & (Value in use)

In this question Fair value less cost of disposal is ( 48000 - 10000 = 38000 )

Value in use = Present value of future cash flows (40000)

So Recoverable Amount is higher of 38000 & 40000 which is 40000.

Now Impairment rule is carrying value should not be more than Recoverable amount. We have recoverable amount now lets find carrying value

Carrying value is Cost - Accumulated depreciation.

So 50000 - 15000 = 35000

U can see Recoverable amount is 40000 & Carrying value is 35000, Carrying value is less than recoverable amount so we will not do any impairment and We will continue to show Asset in Statement of financial position at carrying value which is 35000. Answer is option A

Hope u understand ... U can ask If any doubts

- Messages

- 64

- Reaction score

- 26

- Points

- 18

Hey, yeah. I saw the problem. It's quite different from the rest..View attachment 51924

Can anyone help explain part c) i) only!

Answer sheet says.... 165000-110000=55000

But CRR = par value of shares redeemed - proceeds from issue of new shares

Going that way answer should have been 150000-110000=40000

In the start, you issue shares at 165,000 (150,000+15,000) and later on you redeem shares worth 195,000 (150,000+45,000). Now, since you already have 15,000 in your premium account, you can only use 15,000 to pay the premium while redeeming.. (45,000-15,000) which gives you 30,000. This 30,000 out of 195,000 is taken from retained earnings. You're also issuing new shares worth 110,000. therefore, you're redeeming shares worth 165,000 and issuing 110,000. Hence, giving you 55,000 as your capital redemption reserve.

this I found on Internet & Ma help u .... !!!!

2nd way of understanding this is as follows which i understood ....

As u know we have to maintain our capital to protect rights of creditors ...

As u know in first part equity was 415000 (150,000 + 200,000 + 65,000) which has to be maintained

So opening capital was 350,000 (150,000 + 250,000)

-Shares redeemed were (150,000)

+Shares issued 100,000

= 300,000

But Capital at par should be (415,000 - 60,000) which is 355,000 SO we have to create a reserve of 55,000.

Share premium Calculation is :

Opening 65,000

-Shares redeem premium (15,000)

+Shares issued premium 10,000

= 60,000

Last edited:

- Messages

- 122

- Reaction score

- 242

- Points

- 43

THANKS! I have a few more ques to ask! No. 3, 4, and 7 pls!!IAS 36 states that Asset should not be Written in statement of Financial Position (Balance Sheet) at more than their recoverable amount.

Recoverable Amount = Higher of (Fair value less cost of disposal) & (Value in use)

In this question Fair value less cost of disposal is ( 48000 - 10000 = 38000 )

Value in use = Present value of future cash flows (40000)

So Recoverable Amount is higher of 38000 & 40000 which is 40000.

Now Impairment rule is carrying value should not be more than Recoverable amount. We have recoverable amount now lets find carrying value

Carrying value is Cost - Accumulated depreciation.

So 50000 - 15000 = 35000

U can see Recoverable amount is 40000 & Carrying value is 35000, Carrying value is less than recoverable amount so we will not do any impairment and We will continue to show Asset in Statement of financial position at carrying value which is 35000. Answer is option A

Hope u understand ... U can ask If any doubts

http://onlineexamhelp.com/wp-content/uploads/2012/06/9706_w08_qp_3.pdf

- Messages

- 64

- Reaction score

- 26

- Points

- 18

THANKS! I have a few more ques to ask! No. 3, 4, and 7 pls!!

http://onlineexamhelp.com/wp-content/uploads/2012/06/9706_w08_qp_3.pdf

3) We have to find how man new shares were issued after conversion of Loan stock.

10,00,000 is total loan & 80 % is converted so 10,00,000 * 80% = 800,000

Now we know that 800,000 of Loan Stock is converted So we can use a simple formula

Loan stock converted * Rate of conversion = No. of shares

Loan stock converted is 800,000 & Rate of conversion is 48/100 so

800,000 * 48 / 100 = 384000 So Answer is A

4) We have to Find Net Asset Value per share so we can use simple formula Net Assets / No. of shares

Net Assets after conversion of Loan stock is 1800 - 540 = 1260

Shares after conversion is 1000 + 400 = 1400 (As all loan stock is converted and rate is 1/1 so same formula as used in Q-3 400 * 1/1 = 400

Now put values in formula

Net Assets / No. of Shares = 1260/1400 Answer is 0.90 (B)

7) We have to Find Goodwill, Formula is Net Assets - Consideration (Fair Values for both)

Fair value of consideration = 10,00,000 * 1.50 = 1500,000

Fair value of Net Assets = 700,000

So answer is 1500,000 - 700,000 = 800,000 (C)

Hope u understand

- Messages

- 122

- Reaction score

- 242

- Points

- 43

A few more questions! No. 5, 6, 7, 8 AND 9.3) We have to find how man new shares were issued after conversion of Loan stock.

10,00,000 is total loan & 80 % is converted so 10,00,000 * 80% = 800,000

Now we know that 800,000 of Loan Stock is converted So we can use a simple formula

Loan stock converted * Rate of conversion = No. of shares

Loan stock converted is 800,000 & Rate of conversion is 48/100 so

800,000 * 48 / 100 = 384000 So Answer is A

4) We have to Find Net Asset Value per share so we can use simple formula Net Assets / No. of shares

Net Assets after conversion of Loan stock is 1800 - 540 = 1260

Shares after conversion is 1000 + 400 = 1400 (As all loan stock is converted and rate is 1/1 so same formula as used in Q-3 400 * 1/1 = 400

Now put values in formula

Net Assets / No. of Shares = 1260/1400 Answer is 0.90 (B)

7) We have to Find Goodwill, Formula is Net Assets - Consideration (Fair Values for both)

Fair value of consideration = 10,00,000 * 1.50 = 1500,000

Fair value of Net Assets = 700,000

So answer is 1500,000 - 700,000 = 800,000 (C)

Hope u understand

http://onlineexamhelp.com/wp-content/uploads/2013/11/9706_s13_qp_33.pdf

- Messages

- 64

- Reaction score

- 26

- Points

- 18

I

U have to find out net book value of Asset revalued and subtract it from revalued amount.

Net book value at beginning was 160,000 but then one of the machine is sold so NBV of machine sold has to be subtracted from total to get NBV of remaining machine.

NBV of machine sold :

Sale proceeds = 60,000

Profit = 20,000

we can use formula:

Sale proceeds - Value of machine(NBV) = Profit

60,000 - x = 20,000

So value (NBV) of machine sold is 60,000 - 20,000 = 40,000

Now subtract this from total NBV of machine which is 160,000 u will get 160,000 - 40,000 = 120,000

So NBV is 120,000 and it is revalued to 190,000 so 70,000 is revaluation done on machine. Answer is B

6) Because of Issue of shares Share capital will increase.

Non current liabilities will decrease as debentures are redeemed

Working capital will decrease because We have received cash 50,000 from issue of shares and paid 60,000 for redemption of debentures so Cash will decrease and working capital also because Working capital is Current Asset - Current Liability, As cash is decreasing so current asset will decrease and working capital also, Bonus issue does not involve any cash. So option A is correct.

7) U have to make capital account for X. First take account of profit which is earned when selling partnership which is 285,000 - 235,000 = 50,000

this will be divided between both partners. X will also receive debentures for his loan which he provided to business. He has to receive same amount of interest as he was receiving before so debentures given to him will be:

No. of debentures * 8/100 = 4000 (40,000 * 10 %)

4000 * 100 / 8 = 50,000

So he will receive 50,000 debentures. Now make his capital account

Opening balance is 100,000 + 25,000 (Profit divided equal b/w partners) - 10,000 (current a/c balance) - 50,000 (Debentures) = 65000 So answer is B (Marking scheme has mistake as far as i know)

8) total consideration is 834000, we have to find value of debentures. subtract all other form of consideration other than debenture:

Preference Share (Including premium) = 90,000 * 2.20 = 198000

Ordinary shares (Inckuding Premium) = 300,000 * 1.50= 450,000

So 834,000 - 198,000 - 450,000 = 186,000 So option A

9) Similar to previous question first find out how much we paid through shares & for that subtract all other form of consideration.

260,000 - 60,000 - 80,000 = 120,000

So total amount paid b shares is 120,000

No. of shares * rate = Amount

180,000 * x = 120,000

x = 120,000 / 180,000

x= 0.66667 we know par value is 0.50 so premium is 0.66667 - 0.50 = 0.166667 per share

As total share is 180,000 so 180,000 * 0.166667 = 30,000 (A)

5) U have to find revaluation reserve in this question.A few more questions! No. 5, 6, 7, 8 AND 9.

http://onlineexamhelp.com/wp-content/uploads/2013/11/9706_s13_qp_33.pdf

U have to find out net book value of Asset revalued and subtract it from revalued amount.

Net book value at beginning was 160,000 but then one of the machine is sold so NBV of machine sold has to be subtracted from total to get NBV of remaining machine.

NBV of machine sold :

Sale proceeds = 60,000

Profit = 20,000

we can use formula:

Sale proceeds - Value of machine(NBV) = Profit

60,000 - x = 20,000

So value (NBV) of machine sold is 60,000 - 20,000 = 40,000

Now subtract this from total NBV of machine which is 160,000 u will get 160,000 - 40,000 = 120,000

So NBV is 120,000 and it is revalued to 190,000 so 70,000 is revaluation done on machine. Answer is B

6) Because of Issue of shares Share capital will increase.

Non current liabilities will decrease as debentures are redeemed

Working capital will decrease because We have received cash 50,000 from issue of shares and paid 60,000 for redemption of debentures so Cash will decrease and working capital also because Working capital is Current Asset - Current Liability, As cash is decreasing so current asset will decrease and working capital also, Bonus issue does not involve any cash. So option A is correct.

7) U have to make capital account for X. First take account of profit which is earned when selling partnership which is 285,000 - 235,000 = 50,000

this will be divided between both partners. X will also receive debentures for his loan which he provided to business. He has to receive same amount of interest as he was receiving before so debentures given to him will be:

No. of debentures * 8/100 = 4000 (40,000 * 10 %)

4000 * 100 / 8 = 50,000

So he will receive 50,000 debentures. Now make his capital account

Opening balance is 100,000 + 25,000 (Profit divided equal b/w partners) - 10,000 (current a/c balance) - 50,000 (Debentures) = 65000 So answer is B (Marking scheme has mistake as far as i know)

8) total consideration is 834000, we have to find value of debentures. subtract all other form of consideration other than debenture:

Preference Share (Including premium) = 90,000 * 2.20 = 198000

Ordinary shares (Inckuding Premium) = 300,000 * 1.50= 450,000

So 834,000 - 198,000 - 450,000 = 186,000 So option A

9) Similar to previous question first find out how much we paid through shares & for that subtract all other form of consideration.

260,000 - 60,000 - 80,000 = 120,000

So total amount paid b shares is 120,000

No. of shares * rate = Amount

180,000 * x = 120,000

x = 120,000 / 180,000

x= 0.66667 we know par value is 0.50 so premium is 0.66667 - 0.50 = 0.166667 per share

As total share is 180,000 so 180,000 * 0.166667 = 30,000 (A)

- Messages

- 64

- Reaction score

- 26

- Points

- 18

y isnt paper Section of xtremepapers working?

Don't know but u can find past papers on Max papers as well

- Messages

- 188

- Reaction score

- 158

- Points

- 53

- Messages

- 60

- Reaction score

- 64

- Points

- 28

Mohammad Farzanullah

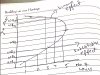

This can be explained by a backward bending labour supply curve. At a level below subsistence level, generally at lower levels of wage rates (when curve is positive sloping) the substitution effect is more dominant because at each higher wage rate, the level will be willing to trade off an hour of leisure with an hour of work in order to make more money. However, if wage rates reach a level where the wage rate is high enough to enable the worker to earn a decent living, the income effect will become more dominant. This means that at each level of wage rate the labour will be willing to work for less number of hours and will use more time for leisure. This is because the wage rate is so high that the labour can earn more money even by offering lesser number of hours. Note that Total Income = Wage Rate X No of hours.

[Please see attachment]

Technically, you can only make a clear judgement about the two effects if it is explicitly stated (or a labour supply curve is given) that at which level of wage rate the labour is currently working at and what is the level of wage rate increase. This is because initially when wage rates increase substitution effect is more dominant and after a certain level income effect become dominant. However, for this question, if we assume that the labour is above subsistence level than with increasing wage rates, income effect should increase while substitution effect should decrease.

Attachments

- Messages

- 17

- Reaction score

- 2

- Points

- 3

Aoa, can you help me find topical papers to solve for both business and economics please? thanks a lot! btw..As levels

- Messages

- 122

- Reaction score

- 242

- Points

- 43

Hi! As for ques no 7, it has been confirmed that there's no error in the answer. My lecturer has checked with the CIE discussion board . 10% of loan must be included in the accounts also.I

5) U have to find revaluation reserve in this question.

U have to find out net book value of Asset revalued and subtract it from revalued amount.

Net book value at beginning was 160,000 but then one of the machine is sold so NBV of machine sold has to be subtracted from total to get NBV of remaining machine.

NBV of machine sold :

Sale proceeds = 60,000

Profit = 20,000

we can use formula:

Sale proceeds - Value of machine(NBV) = Profit

60,000 - x = 20,000

So value (NBV) of machine sold is 60,000 - 20,000 = 40,000

Now subtract this from total NBV of machine which is 160,000 u will get 160,000 - 40,000 = 120,000

So NBV is 120,000 and it is revalued to 190,000 so 70,000 is revaluation done on machine. Answer is B

6) Because of Issue of shares Share capital will increase.

Non current liabilities will decrease as debentures are redeemed

Working capital will decrease because We have received cash 50,000 from issue of shares and paid 60,000 for redemption of debentures so Cash will decrease and working capital also because Working capital is Current Asset - Current Liability, As cash is decreasing so current asset will decrease and working capital also, Bonus issue does not involve any cash. So option A is correct.

7) U have to make capital account for X. First take account of profit which is earned when selling partnership which is 285,000 - 235,000 = 50,000

this will be divided between both partners. X will also receive debentures for his loan which he provided to business. He has to receive same amount of interest as he was receiving before so debentures given to him will be:

No. of debentures * 8/100 = 4000 (40,000 * 10 %)

4000 * 100 / 8 = 50,000

So he will receive 50,000 debentures. Now make his capital account

Opening balance is 100,000 + 25,000 (Profit divided equal b/w partners) - 10,000 (current a/c balance) - 50,000 (Debentures) = 65000 So answer is B (Marking scheme has mistake as far as i know)

8) total consideration is 834000, we have to find value of debentures. subtract all other form of consideration other than debenture:

Preference Share (Including premium) = 90,000 * 2.20 = 198000

Ordinary shares (Inckuding Premium) = 300,000 * 1.50= 450,000

So 834,000 - 198,000 - 450,000 = 186,000 So option A

9) Similar to previous question first find out how much we paid through shares & for that subtract all other form of consideration.

260,000 - 60,000 - 80,000 = 120,000

So total amount paid b shares is 120,000

No. of shares * rate = Amount

180,000 * x = 120,000

x = 120,000 / 180,000

x= 0.66667 we know par value is 0.50 so premium is 0.66667 - 0.50 = 0.166667 per share

As total share is 180,000 so 180,000 * 0.166667 = 30,000 (A)

Last edited:

- Messages

- 44

- Reaction score

- 20

- Points

- 18

How to treat inventory drawings in income statement and balance sheet?

Acha tel me something.. What do you suggest if someone asks u between accounts and eco? Which should be taken? is eco difficult or accounts? I have heard mixed reviewsDon't know but u can find past papers on Max papers as well